personal property tax rate richmond va

Web The total tax is 5 percent 4 percent state and 1 percent local A seller is subject to a sales tax on gross receipts derived from retail sales or leases of taxable tangible personal. Web Personal Property Tax Relief.

Virginia Tax Rates Rankings Virginia State Taxes Tax Foundation

Under Virginia law the.

. False Alarm Fees Restricted Parking District Permits Tangible Personal Property Tax Utility Taxes. Web Local Tax Rates. Business Tangible Personal Property Tax Return2021 2pdf.

Web It is estimated that by freezing the rate the city will provide Richmonders more than 8 million in additional relief. Web Taxpayers now have until August 5 2022 to pay personal property tax car tax and machinery tools tax without penalty or interest. Web ALL RATES ARE PER 100 IN ASSESSED VALUE For Town of Warsaw tax rates please contact the Town of Warsaw office at 804 333-3737.

Web If you have additional questions please contact the Department of Finance. Web The City Assessor determines the FMV of over 70000 real property parcels each year. Richmond County collects on average 045 of a.

Welcome to the official site of the Virginia Department of Motor Vehicles with quick access to driver and vehicle online transactions and. The Local Tax Rates Survey is published by the Department of Taxation as a convenient reference guide to selected local tax rates. Web Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in.

This rate is applied to the assessed value of your property as determined by the city assessor. The real estate tax is the result of multiplying the FMV of the property times the real estate. 074 of home value Tax amount varies by county The median property tax in Virginia is 186200 per year for a.

Richmond City is ranked 387th of the 3143 counties for property. Web The median property tax in Richmond County Virginia is 673 per year for a home worth the median value of 148700. The daily rental property tax is collected by businesses that derive at least 80 percent.

Make sure you receive bills for all property that you own. If you have an issue or a question related to your personal. Web There are three basic steps in taxing property ie formulating levy rates assigning property market values and collecting tax revenues.

Web The daily rental property tax is collected by businesses that derive at least 80 percent of their rental receipts excluding the rental of vehicles licensed by the state from rental of. Web Below you will find links and resources to pay admissions lodging meals real estate and personal property taxes as well as parking violations online. Web The average yearly property tax paid by Richmond City residents amounts to about 346 of their yearly income.

Tax Due Date Extended by. Web Virginia Property Taxes Go To Different State 186200 Avg. Tax rates differ depending on.

Web Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia. Web December 5 th-- Real Estate Personal Property Taxes. Web The current property tax rate in Richmond Virginia is 120.

Web Any returns filed after May 1 st are assessed a late filing fee of ten dollars 10 or ten percent 10 of the tax assessed whichever is greater. Web Richmond City is ranked 387th of the 3143 counties for property taxes as a. Contact the Treasurers Office at.

Virginia Business Personal Property Tax A Guide

No Change To Richmond S Real Estate Tax Rate But Rebate Checks Could Come Next Year Wric Abc 8news

Tangible Personal Property State Tangible Personal Property Taxes

Richmond Virginia Va Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Soaring Property Taxes Renew Calls For Cuts Richmond Free Press Serving The African American Community In Richmond Va

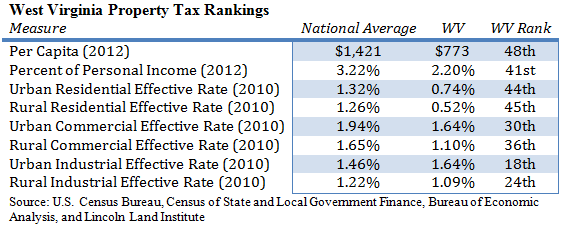

What S The Real Reason For Eliminating Business Personal Property Taxes West Virginia Center On Budget Policy

Virginia Business Personal Property Tax A Guide

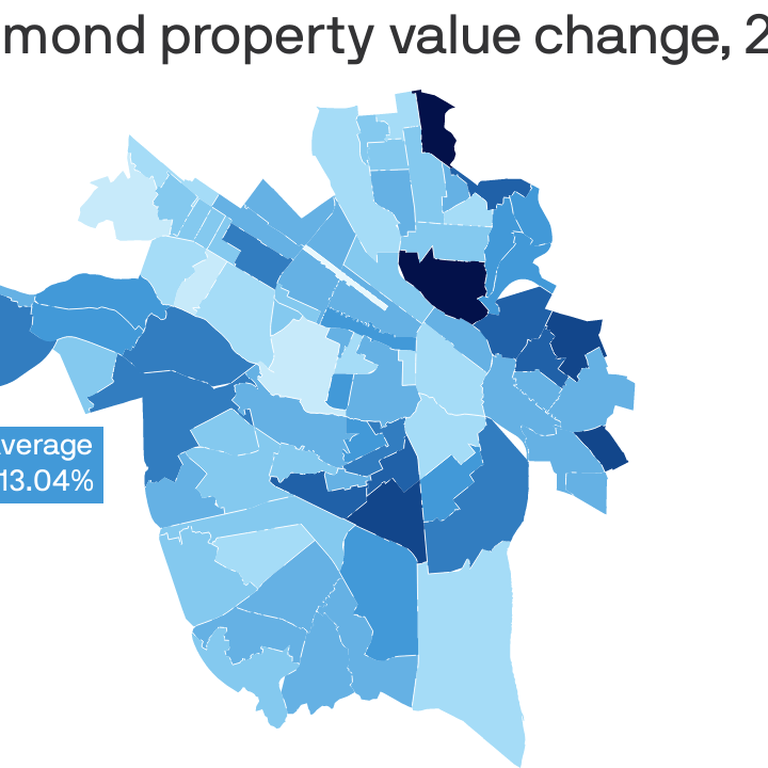

Where Richmond Property Values Went Up Most Axios Richmond

Richmond Property Tax How Does It Compare To Other Major Cities

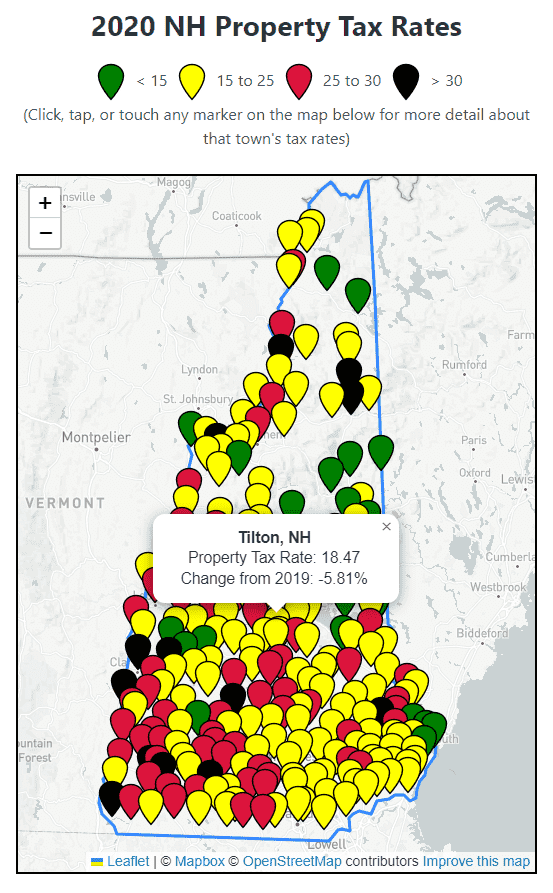

2020 New Hampshire Property Tax Rates Nh Town Property Taxes

Richmond Extends Deadline To Pay Personal Property Taxes Wric Abc 8news

Virginia Property Tax Calculator Smartasset

Are There Any States With No Property Tax In 2022 Free Investor Guide

Virginia Property Tax Calculator Smartasset

News Flash Chesterfield County Va Civicengage

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Politifact Virginia Stoney Mostly True On Richmond Tax Claim Vpm

Frustrations Rise In Henrico As Personal Property Tax Bills Increase

Richmond Va Cost Of Living 2022 Is Richmond Va Affordable Data Tips Info